Find High-Paying Jobs in the UAE

Welcome to Alrafaq Group—your trusted UAE platform for high-paying job opportunities, expert recruitment services, and career-focused jobs. Discover top employers, explore in-demand careers, and take the next step toward a brighter future today.

Discover Latest Jobs in Dubai—Apply Today

Mega Warehouse & Online supermarket

Now Hiring: High-Paying Warehouse & Logistics Jobs in Dubai—Apply Today

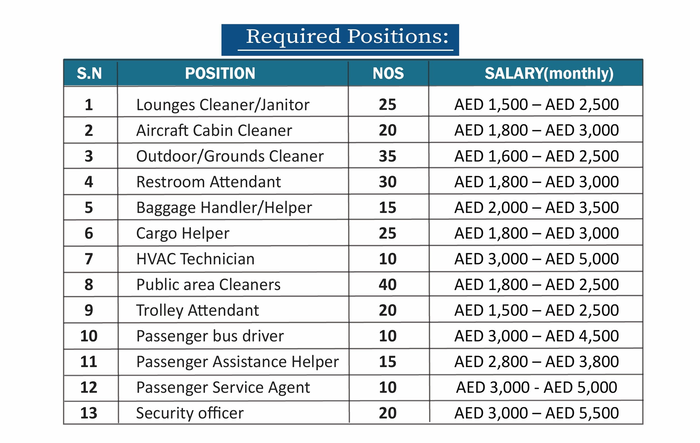

Airport job vacancies

Launch Your High-Paying Aviation Career—Apply for Top Airport Jobs in the UAE Today!

Land High-Paying UAE Jobs: Expert Career & Hiring Tips for Professionals

Every great career begins with one step; at Alrafaq, we help you toward high-paying employment all around the UAE. Alrafaq is more than just a collection of companies; it’s your portal to top-paying employment in sectors including construction, healthcare, finance, and technology as a reputable UAE-based recruiting and career platform.

Alrafaq links you with confirmed companies, quick hiring positions, and in-demand professions regardless of your location, job hunt, or expat professional background. Start your path on a platform meant to provide consistent employment opportunities, recruiting tools, and professional development.

Leading Career Guidance from UAE Industry Professionals

Strong, useful employment advice is shared by our network of recruiting managers and seasoned professionals around the Emirates. Let’s see how professionals in each field are mentoring the upcoming generation.

Advice for Career Advancement from UAE Medical Experts

“In healthcare, passion meets precision,” says Dr. Lina Hassan, chief of staff of a prestigious hospital in Sharjah.

Dr. Lina Hassan

Her recommendations for aspiring professionals are as follows:

• Emphasize soft skills like communication and empathy

• Maintain certification through the UAE Ministry of Health & DHA programs.

• Gain hands-on experience in research labs or hospital internships.

Radiology, physiotherapy, pharmacy, and nursing are all in high demand; Alrafaq helps put you in the correct location. View the most recent job openings.

Perspectives from UAE Construction Leaders

“Be adaptable.” A senior project manager in Dubai, Mr. Tariq Al Mazrouei, offers his thoughts on the thriving construction industry in the United Arab Emirates.

Tariq Al Mazrouei

He advises young engineers to focus on

• Acquiring hands-on experience on a real-world site

• Learning Primavera P6, a modern project management technology

• Staying up to date with green construction standards.

Building involves more than just physical construction; it also involves strategy, creativity, and personnel management. Examine the most recent openings in the construction industry.

Voices from the Tech Sector: New Positions & Competencies

“The United Arab Emirates is leading the way in digital transformation, and you should be too,” says Aisha Farooq, lead developer at a Dubai AI startup.

Aisha Farooq

Tech workers should focus on cybersecurity and cloud certifications:

• learn Python, React.js, or AI/ML technologies

• Focus on cybersecurity and cloud certifications

• Create a personal portfolio website, according to Aisha Farooq, head developer at a Dubai AI firm.

Creating a Standout Profile That Employers Notice

Your profile is your first impression. Use a professional photo, write a compelling summary, and include certificates and achievements.

High-Paying Career Opportunities in the UAE’s Luxury Tourism & Hospitality Sector with Alrafaq

With Alrafaq, you may find top job openings in the United Arab Emirates (UAE), where you can work your way up the ladder in the travel and tourism industry or take advantage of the developing luxury hotel and resort sector.

Your search ends here if you are eager to advance your career with a leading UAE luxury property. Al Rafaq is pleased to provide a wide range of employment opportunities with prominent UAE-based hospitality companies. These jobs provide great chances to move up, a good salary, and benefits. We provide nuggets of information on the hospitality and tourist industry that anyone can use, from complete novices to seasoned pros. You should advance in your career right now.

Why Choose a Tourism & Hospitality Career in the UAE?

As we know, the UAE has a strong economy and a growing tourism industry, making it a great place for hospitality professionals. Working for a leading company in the area can give you good experience in a busy setting. You will also have a lot of opportunities to get better at what you do and go up in your profession. Because of this, the UAE is a good choice for people who want to build a successful career in the tourism & hospitality industry.

What We Are Looking For:

At Al Raqaf, we collaborate with top firms to identify driven and enthusiastic professionals or novices who wish to pursue a career in the travel and hospitality sector. The following attributes will be acquired by the appropriate candidates based on Al Rafaq’s insights:

• With a tourism and hospitality management degree, start your own business and find employment with a number of prestigious companies.

• Strong interpersonal and communication abilities.

• Experience working in the hotel industry (for certain professions).

• A focus on the client and a dedication to providing outstanding service.

• English proficiency.

How to Apply for a Job:

Ready to elevate your hospitality career and seize one of these thrilling opportunities? Applying is a breeze! Explore exciting job opportunities in the UAE through the Alrafaq career portal. Match with your desired position & easily submit your application today. Seize the opportunity to join a premier bank in the UAE and elevate your career in the vibrant tourism and hospitality industry.

For anyone interested in advancing their career in the tourism and hospitality industry, this essay is written with the intention of being informative, entertaining, and useful. Additionally, it motivates individuals to apply for the most recent job openings that are a good fit for their skills and experience.

Necessary Insurance in the UAE for Foreign Employees

With the emergence of various business sectors, including the tourism and hospitality industries, the UAE has become attractive for career opportunities and a destination for job seekers. Its powerful economy, diverse workplace, and exciting employee benefits are attracting thousands of job seekers annually from different nations. But many of us are unaware of the necessary insurance that should not be avoided by employees of any nationality. This article is here to guide you and provide all the necessary information on insurance and compensation.

Workers’s Compensation Insurance

Accidents and injuries may occur while working. Workers’ compensation is there to provide compensation for incidents that may happen. It works as a shield for the workers. The workmen’s compensation insurance covers hospital expenses, lost salary insurance, and benefits for the family because of an unfortunate death in the workplace.

Workers’ compensation insurance typically covers the following:

• Medical Expenses: Costs for treatment, rehabilitation, and hospitalization.

• Lost Wages: A portion of an employee’s salary during recovery.

• Disability Benefits: Compensation for temporary or permanent disability.

• Death Benefits: The deceased worker’s family is supported financially.

Penalties for Not Following the Rules

Ignoring workers’ compensation insurance could have dire effects on businesses, including

• Fines and penalties applied by regulatory authorities.

• Suspension or closing of company activities.

• possible legal conflicts and damage to reputation.

Health Insurance

Whether you are in Dubai or any other emirate, all employees within the UAE must be provided with health insurance by their employers according to the UAE labor law. Additionally, it is the responsibility of businesses and employers to assume the responsibility of providing health insurance to their staff members. The Dubai Health Authority (DHA) has announced that employers must provide the Essential Benefits Plan (EBP) to their employees.

What Health Insurance Covers:

• Doctor consultations

• Emergency treatments

• Surgeries

• Prescription medicines

• Maternity care

In the UAE, compensation insurance for workers is very important for businesses. Businesses can protect their most valuable asset—their employees—by knowing how important it is to follow the law. This helps make the workplace safer and more effective. Companies that focus on workers’ compensation insurance show that they care about the law and the health and safety of their employees.

Let’s work together on your next dream job

Ready to take your career to the next level? Partner with us to create innovative ideas for building resumes and job-searching strategies, drive meaningful engagement, and achieve measurable results. Let’s turn your vision into reality—together.